Does Medicare Cover Dental Implants?: Dental health plays a vital role in maintaining overall wellness. For seniors and other individuals on Medicare, the cost of dental care—especially dental implants—can be a major concern. If you’re wondering whether Medicare covers dental implants, this article unpacks the truth, explains your options, and provides practical tips to make the best financial and health-related decisions.

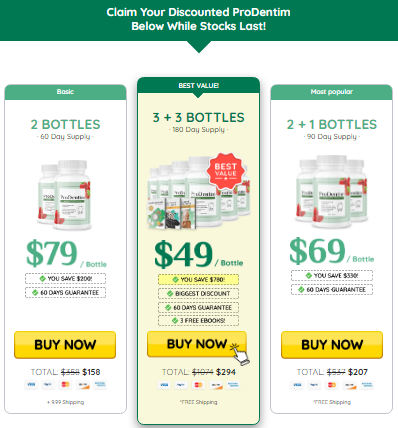

👉 Don’t wait — Order ProDentim from the Official Site

What Are Dental Implants?

Dental implants are artificial tooth roots, usually made of titanium, surgically inserted into the jawbone. They provide a strong foundation for replacement teeth, such as crowns, bridges, or dentures. Here are the three main components of a dental implant:

- Implant: The screw-like base inserted into the jawbone.

- Abutment: The connector that holds the replacement tooth.

- Crown: The visible, tooth-like component.

Dental implants offer several benefits:

- Improved appearance and speech.

- Better comfort and functionality compared to traditional dentures.

- Prevention of jawbone deterioration.

- Long-lasting results, often lasting decades with proper care.

However, they come at a high cost, ranging from $3,000 to $6,000 per tooth, depending on the complexity of the procedure and location.

👉 Don’t wait — Order ProDentim from the Official Site

Does Medicare Cover Dental Implants?

The short answer is no, Original Medicare (Part A and Part B) does not typically cover dental implants or routine dental care. Here’s why:

- Medicare categorizes dental procedures, including implants, as elective or cosmetic unless deemed medically necessary.

- Medicare’s dental coverage is extremely limited, focusing only on procedures directly tied to other covered medical services.

When Does Medicare Cover Dental Procedures?

There are rare instances when Medicare might cover dental work, including implants. These include:

- Medically Necessary Situations: If dental care is required as part of a larger medical procedure, such as reconstructive surgery following an accident or disease.

- Hospital-Based Dental Procedures: Medicare Part A may cover hospital costs if a dental procedure is performed in a hospital setting due to medical complications.

Unfortunately, routine dental work, including cleanings, fillings, and implants, is not covered under these circumstances.

Exploring Alternatives: Medicare Advantage and Supplemental Plans

Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies approved by Medicare. Many of these plans include additional dental benefits, which may cover:

- Routine dental exams and cleanings.

- X-rays and fillings.

- Partial or full coverage for dental implants.

Important Note: Coverage varies widely between plans, so it’s crucial to compare policies carefully. Check for details on:

- Annual maximum limits.

- Coinsurance rates.

- Whether your preferred dentist is in-network.

Stand Alone Dental Insurance Plans

If your Medicare Advantage plan doesn’t cover dental implants, you can purchase a separate dental insurance policy. Some policies specifically cater to seniors and include:

- Coverage for implants after a waiting period.

- Annual maximum benefits ranging from $1,000 to $5,000.

- Options for in-network and out-of-network providers.

Dental Discount Plans

Another option is enrolling in a dental discount plan. While not insurance, these plans offer discounts on various dental procedures, including implants, in exchange for a membership fee. Benefits include:

- No waiting periods.

- Significant savings on implant costs.

- Flexibility to choose from participating dentists.

Financial Assistance for Dental Implants

Dental implants are expensive, but several financial aid options can help reduce out-of-pocket costs.

Medicaid

Medicaid, a state and federally funded program, may cover dental implants in some states. Coverage eligibility depends on:

- State-specific Medicaid rules.

- Whether the implants are deemed medically necessary.

Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

If you have an HSA or FSA, you can use these tax-advantaged accounts to pay for dental implants. Benefits include:

- Reducing your taxable income.

- Using pre-tax dollars for qualified medical and dental expenses.

Payment Plans and Financing Options

Many dental clinics offer financing options to help patients manage implant costs. Popular options include:

- CareCredit: A healthcare credit card with interest-free promotional periods.

- In-house financing: Payment plans directly arranged with your dental provider.

Nonprofit Organizations and Charities

Some organizations provide financial assistance or free dental care to eligible individuals. Examples include:

- Dental Lifeline Network: Offers comprehensive dental services to people with disabilities, seniors, or those who cannot afford care.

- Donated Dental Services (DDS): Provides free dental care, including implants, through volunteer dentists.

How to Find the Best Dental Coverage for Implants

Finding the right dental coverage for implants requires thorough research. Here are actionable steps:

- Assess Your Needs: Determine the extent of your dental needs and whether implants are a priority.

- Compare Medicare Advantage Plans: Use Medicare’s Plan Finder tool to identify plans with dental benefits.

- Research Standalone Dental Insurance: Look for policies that cover implants and compare premiums, waiting periods, and annual maximums.

- Check Dentist Networks: Ensure your preferred dentist accepts the insurance plan.

- Seek Professional Advice: Consult a licensed insurance agent or financial advisor for tailored recommendations.

Table: Comparison of Coverage Options for Dental Implants

| Coverage Option | Covers Dental Implants? | Key Features |

| Original Medicare (Part A & B) | Rarely | Only covers dental work tied to medical conditions. |

| Medicare Advantage (Part C) | Sometimes | Varies by plan; often includes routine dental care. |

| Standalone Dental Insurance | Yes (partially) | May cover implants after waiting periods. |

| Medicaid | Depends on the state | Coverage for medically necessary implants in some states. |

| Dental Discount Plans | Yes | Offers discounts rather than direct coverage. |

| HSAs/FSAs | Yes | Use pre-tax funds to pay for implants. |

Key Takeaways: Pros and Cons of Dental Implants

Pros:

- Durability: Implants last significantly longer than dentures or bridges.

- Functionality: Mimics natural teeth in appearance and performance.

- Bone Preservation: Prevents jawbone loss.

- Comfort: Eliminates the discomfort of removable dentures.

Cons:

- Cost: Implants are expensive, with limited insurance coverage.

- Surgery Risks: Includes infection, nerve damage, or implant failure.

- Time-Consuming: The process can take several months, including healing time.

- Maintenance: Requires consistent oral hygiene to prevent complications.

FAQs: Does Medicare Cover Dental Implants?

1. Can I get dental implants covered if I have Medicare Advantage?

Yes, many Medicare Advantage plans offer dental benefits, but coverage for implants depends on the specific plan.

2. Does Medicaid cover dental implants?

In some states, Medicaid covers implants if deemed medically necessary. Check with your state’s Medicaid office for details.

3. How can I reduce the cost of dental implants?

Consider dental discount plans, financing options, nonprofit assistance programs, or tax-advantaged accounts like HSAs and FSAs.

4. Are dental implants worth the cost?

While costly, implants provide long-term benefits, including improved functionality, comfort, and oral health.

5. What is the best alternative if I can’t afford implants?

Other options include dentures, bridges, or partial dentures, which are more affordable but less durable.

👉 Don’t wait — Order ProDentim from the Official Site

Conclusion: Does Medicare Cover Dental Implants?

While Original Medicare doesn’t typically cover dental implants, there are several alternative options to explore. Medicare Advantage plans, stand alone dental insurance, and discount plans can help cover some costs. Additionally, financial aid programs and flexible financing can make implants more affordable.

If dental implants are essential for your health and quality of life, take the time to research coverage options, consult with dental professionals, and consider financial assistance programs. By being proactive, you can manage costs and achieve a healthier, more confident smile!

👉 Don’t wait — Order ProDentim from the Official Site